Financial literacy isn’t just about understanding dollars and cents; it’s a crucial life skill that empowers people to make informed decisions about earning, spending, saving, and investing. In today’s complex financial landscape, teaching money management to students has never been more essential. With rising student debt, increasing economic challenges, and a fast-changing job market, equipping young people with financial knowledge is a pathway to long-term stability and success.

The Importance of Financial Literacy in Education

Many Americans struggle with financial insecurity due to a lack of basic financial knowledge. In fact, 78% live paycheck to paycheck, and one in five individuals over 50 have no retirement savings. Alarmingly, only half of the population is financially literate, and Gen Z scores particularly low on financial literacy tests. This gap in financial understanding can lead to long-term economic disadvantages and perpetuate cycles of poverty.

Financial literacy isn’t just about managing money; it’s about empowering students to make informed decisions that will impact their entire lives. Teaching students about personal finance helps them build wealth, manage debt effectively, and reduce financial stress. Moreover, early financial education fosters responsible habits that can lead to a more secure future.

The Current State of Financial Literacy in Schools

Despite its importance, financial literacy education in schools is inconsistent. Many states incorporate financial concepts into existing courses like math or economics, which often results in fragmented and shallow learning experiences.

Educators often face challenges such as a lack of resources, insufficient training, and limited class time dedicated to financial education. Additionally, financial literacy isn’t always prioritized within the curriculum, leaving many students without essential money management skills.

The Impact of Financial Education on Students

Teaching financial literacy has profound, long-term benefits. Students with financial literacy education are better at budgeting, saving, handling credit, and avoiding predatory loans. For example, a 2020 study revealed that young adults with three years of financial literacy in high school were 40% less likely to miss credit payments and had credit scores 25 points higher than their peers without such education.

Furthermore, financial education doesn’t just benefit students. Parents of financially literate students reportedly gain higher credit scores and reduce loan default rates, indicating that financial literacy education can have a ripple effect throughout communities.

Key Components of Effective Financial Literacy Programs

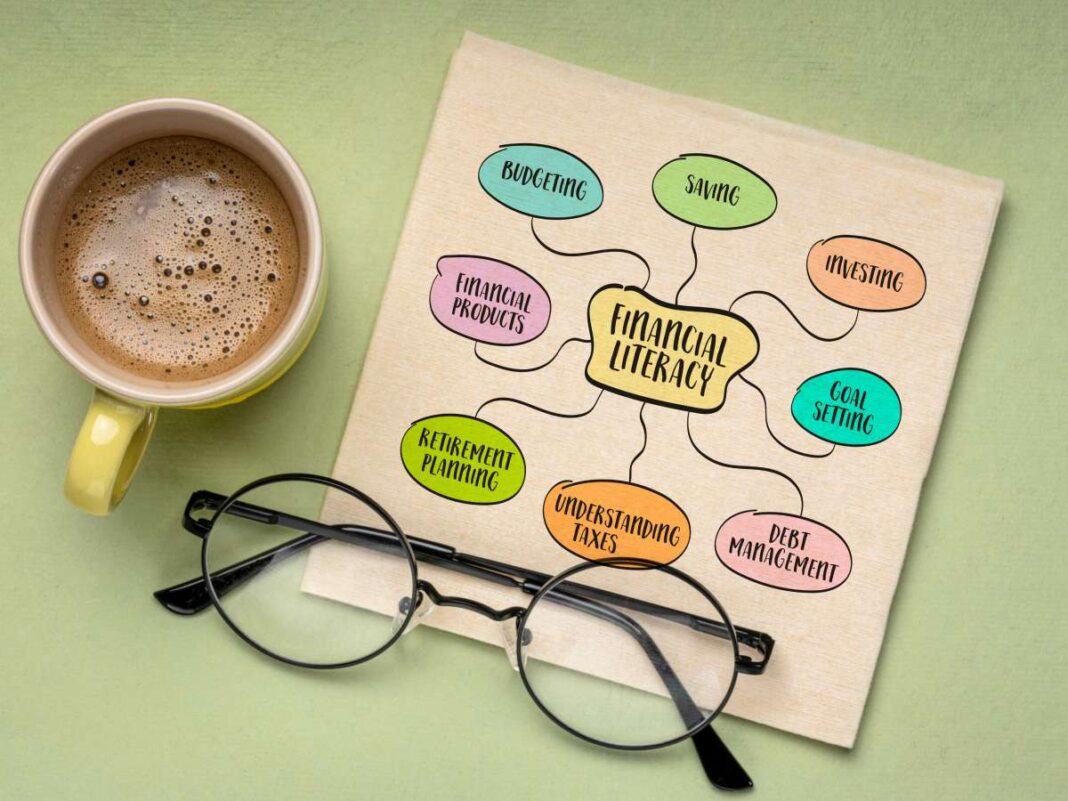

An effective financial literacy program should cover several core areas to ensure students gain a comprehensive understanding of personal finance. These components include:

Saving and Budgeting

Students should learn the importance of setting financial goals, creating budgets, and understanding the difference between needs and wants. Building a habit of saving and budgeting can empower students to manage their resources wisely and prepare for unforeseen expenses.

Managing Credit and Debt

Understanding credit scores, interest rates, and debt management is crucial. Teaching students about responsible borrowing and the implications of debt can help them make informed decisions when it comes to student loans, credit cards, and other forms of credit.

Investing and Wealth Building

Introducing students to basic investment concepts can set the foundation for future wealth building. By learning about different investment vehicles, risk tolerance, and the power of compound interest, students can begin to appreciate the benefits of long-term financial planning.

Innovative Strategies for Teaching Financial Literacy

Educators have developed creative methods to make financial literacy engaging and relevant:

Interactive Games and Simulations

Programs like “The Real Game” allow students to simulate adult life, including career choices, budgeting, and financial planning. These interactive experiences help students understand the real-world implications of financial decisions.

Project-Based Learning

Activities like the “Bean Game” enable students to prioritize spending using tokens (beans) to represent money. This hands-on approach makes abstract concepts tangible and fosters critical thinking.

Integration with Technology

Using online tools and apps, such as budgeting software or stock market simulators, can make learning about finance more engaging. Integrating technology helps students become familiar with digital financial tools they will use in the future.

Collaboration with Financial Experts

Inviting professionals to speak to students or partnering with organizations specializing in financial education can provide valuable real-world insights. For instance, some schools collaborate with nonprofits like Junior Achievement to offer immersive learning experiences.

Addressing Financial Literacy Disparities

Low-income families may avoid discussing finances due to economic stress, and schools in underserved areas often lack access to financial literacy courses.

To combat these disparities, organizations like Educate. Radiate. Elevate. are providing no-cost tutoring programs tailored to low-income children. By incorporating financial literacy into their programs, they aim to empower underserved students with essential skills to navigate the financial system confidently.

Incorporating Financial Literacy into Existing Curricula

Even without standalone financial literacy courses, educators can integrate money management concepts into existing subjects:

- Mathematics: Teach budgeting, interest calculations, and data analysis using financial contexts.

- Social Studies: Discuss the impact of economic policies, taxation, and historical financial events.

- Language Arts: Analyze texts that deal with financial themes or encourage students to write essays on financial topics.

Resources for Educators

There are numerous free resources available to assist educators in teaching financial literacy:

- FDIC’s Money Smart for Young People: Offers curricula for different age groups with lesson plans and activities.

- Intuit for Education: Provides a library of financial literacy resources, including simulations and technology tools.

- Khan Academy: Features courses on personal finance covering a wide range of topics from budgeting to investing.

The Role of Parents and Caregivers

Financial education doesn’t stop in the classroom. Parents and caregivers play a crucial role in reinforcing financial concepts at home. By engaging in conversations about money, involving children in budgeting activities, and modeling responsible financial behavior, adults can significantly influence their children’s financial attitudes and habits.

The Path Forward: Building a Financially Literate Generation

As we recognize the critical importance of financial literacy, it’s imperative to ensure that all students have access to quality financial education. By implementing comprehensive programs, utilizing innovative teaching strategies, and addressing systemic disparities, we can equip the next generation with the tools they need for financial success.

Investing in financial literacy is investing in the future stability and prosperity of our society. When students understand money management, they are better prepared to navigate life’s challenges, seize opportunities, and contribute positively to the economy.